home

about

artists

exhibitions press

contact

purchase

home

about

artists

exhibitions press

contact

purchase |

|

|

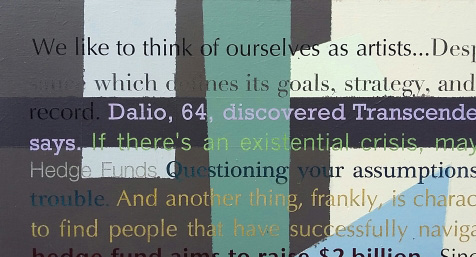

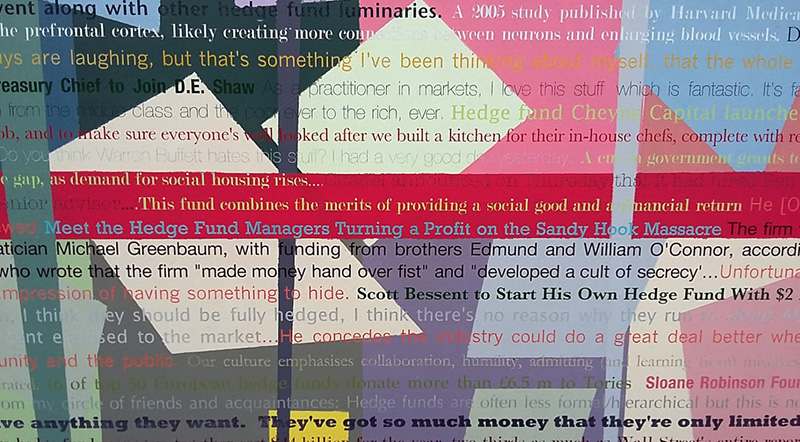

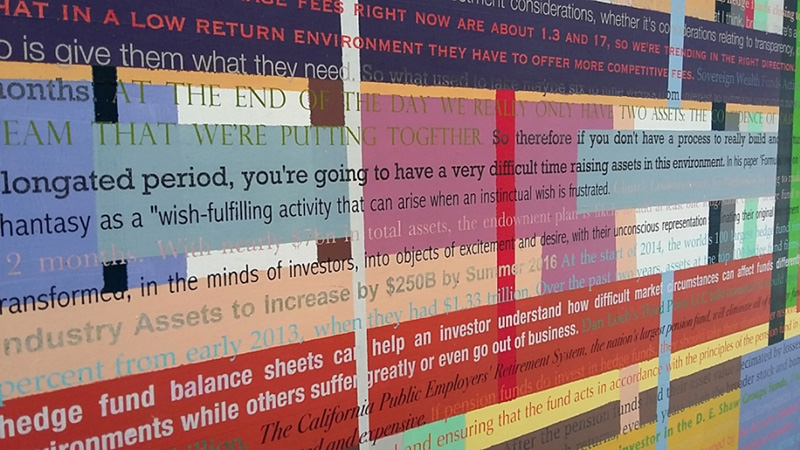

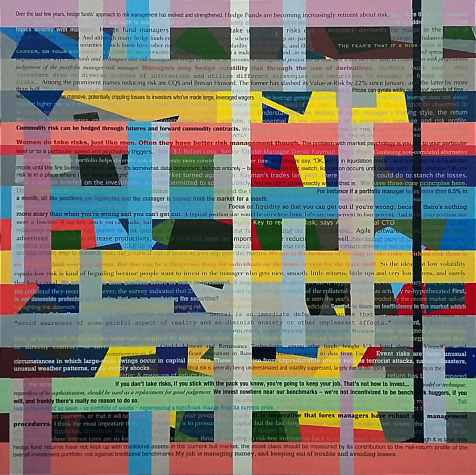

LARRY McGINITY Art as a Derivative III The Hedge Fund Industry

I have recently completed a new series of 15 paintings under the Art as a Derivative banner Art as a Derivative III The Hedge Fund Industry. For my work on hedge funds I have unearthed tens of thousands of words of verbatim text from key players, economists and academics. I have read numerous articles in the financial sections of journals and transcribed a host of video interviews and forums. It is from these texts that I assemble my 'dialogues'. A painting with 1500 words of text has to captivate the viewer, but I love language and have relished piecing together these themed dialogues. Typography and colouration are used to identify each strand of text and create a heightened visual impact. Each painting is 105cm x 105cm.

Honing down my assembled texts, I identified fifteen key themes so each painting addresses a specific aspect of the hedge fund industry. My research has taken me into the dry but essential world of regulation the broad sweep of SEC Committee findings, AIFMD, 13F reports and FCA policy. I have garnered opinion on the various and expanding realms of hedge fund strategies, their merits and pitfalls. I have also, most importantly, logged the views and 'edge' of many of the leading participants and their take on the key issues confronting their industry and the wider economy. But hedge funds wouldn't be hedge funds if there were not the tales and anecdotes of high rewards and spending excess; stories of luxury, hedonism, extraordinary bequests and political power-play. These are also the ingredients that pepper the surface of this new Art as a Derivative series.

In recent times, industry luminaries such as such as Crispin Odey have spoken of being "saddened" that public understanding of his secretive industry is too negative and has called for more transparency. Indeed, only a couple of months ago Carlyle Group's David Rubenstein, when speaking at SALT 2016, suggested that such misunderstanding combined with tales of excessive rewards was having a negative impact on investment. He also called for an appraisal of the industry's public persona, suggesting that the industry may not be best placed to provide the narrative. Now Art as a Derivative lets industry critics and advocates participate in a much-needed forum. That's why its time has come... And one final thing in recent times there has been a plethora of articles in the press and even TV documentaries about art as the sassy (and possibly most dependable) new asset class on the block. But I feel there has been little interest in the impact of big money in shaping the aspirations and practice of today's artists. So for balance, I wanted to reverse the lens and have an artist weigh up, discuss and hold up to the light the ebbs and flows of capital in financial markets.

A catalogue providing full and comprehensive accreditation to all references included in the artworks will accompany any future exhibition of the work. Larry McGinity |

|

|

|

E-mail: info@hayhillgallery.com |

These

are the titles of the paintings in the series:

These

are the titles of the paintings in the series: